Taking API Automated Testing in Financial firms to the Next Level

Utilizing APIs in a data-heavy industry like banks, credit unions and lending firms has become key in enabling digital transformation. APIs allow banks, credit unions and lending firms to create connectivity and facilitate interactions among applications and devices by providing a standard way to share and access data between software systems. Banks, credit unions and lending firms can create better experiences for customers, who will receive faster service. Banks, credit unions and lending firms can also utilize larger pools of data to unlock data-driven benefits — from real-time risk assessment, and user-based banks, credit unions and lending firms, to customized products. Through API integrations, banks, credit unions and lending firms can also offer expansion possibilities into new market segments via partners and third parties.

Organizations operating in the digital age need high performing, reliable APIs. Since important data passes through APIs, they need to be secure — which means they need to be designed, tested, and governed appropriately. Banks, credit unions and lending firms must embrace comprehensive quality assurance strategies, and continuously conduct rigorous testing throughout the development process to ensure that all interfaces are both robust and flexible, supporting the business as it grows.

The Case for API Testing Automation

Any solid quality engineering strategy will involve test automation, which is an essential part of creating high performing software. Since APIs require constant feedback as part of both testing and deployment—to validate the API code, validate the request and response, and track the errors—adopting automation can allow banks, credit unions and lending firms to significantly enhance their testing cycles.

Instead of manually testing APIs — a time-consuming and inefficient process —automating API tests saves time and reduces cost long-term, while increasing the quality and reliability of software.

Since API testing does not need GUI to be ready, automated testing can be done early in the process of software development and provides quicker test results — within minutes — to help remove bugs and defects upfront. What this means is that developers adding functions to applications can easily and accurately identify any errors in API mechanics, keep track of the errors, and thus introduce new features with confidence. Essential quality platform testing including unit testing, load testing, functional testing and penetration testing can be automated.

These automations can also be reused, or even repurposed and applied in different scenarios, and used to test multiple components of an application. For example, automated functional tests can be adapted into API security tests that examine vulnerabilities in coding patterns or project manifest files. The significance of this data protection will grow as banks, credit unions and lending firms look to expand their ecosystem and integrate with more and more partners.

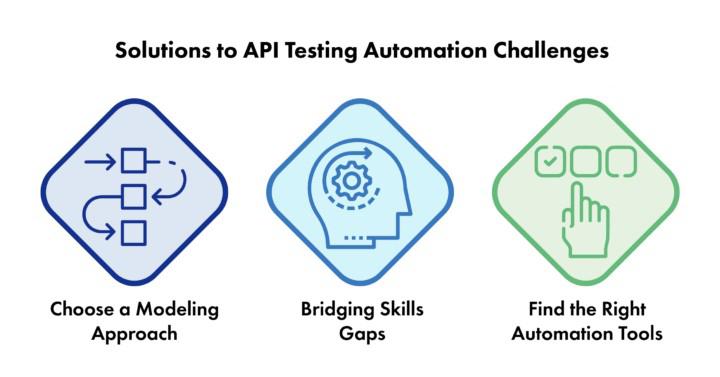

Solutions to the Main Challenges with API Testing Automation

In helping banks, credit unions and lending firms leverage test automation to deliver on business transformation, ValueMomentum’s QE experts have observed the emergence of a few challenges with API testing automation. Here are three challenges facing companies that would like to automate API tests, and ideas on how to address them:

1. Choosing a modeling approach to API test automation

Shifting to automated testing requires companies to reframe how they organize a significant portion of the development process. It requires upfront work to establish a model that works — by clarifying the requirements of the tests, how a test will be designed and approved, the execution of the test, and how results will be handled, companies can create work flowcharts and guidelines for testing cycles. Systemic approaches to automated testing are needed to create quality assurance plans, and there are many aspects to consider.

For example, since APIs often do not exist in isolation, it is important to understand how various environments and interdependent APIs interact with the API being tested. APIs that are chained together require complex navigation, and testing models need to incorporate knowledge of the different routes data can flow through. Another consideration is how the testing data will be used, since with quicker automated tests, results can flow in and easily create a backlog of requests. It is crucial to build a strategy for determining which issues are the highest priority.

Organizations must decide how API automated testing will work best for them, based on their business functional capabilities. Additionally, it’s important to maintain a central modelling strategy to keep automation designs, test data, and team responses organized.

2. Bridging skills gaps on software development teams

As banks, credit unions and lending firms transition from legacy systems to modern platforms and digital ecosystems, innovative and nontraditional thinking is necessary within their teams. Expanding any test automation strategy requires teams to upskill or hire trained talent from outside. Teams leading testing initiatives need the framework and technical skills to design, develop, integrate, and troubleshoot APIs. Testers should have domain knowledge, and even if some tools do not require them to write scripts, they should know the programming language used by the development team, and they should have enough background to know what response can address any request accurately. Testers should also have experience in manual testing so that they can discern when automation is appropriate, and when manual testing may be necessary. They may also need to understand test management tools, so that they know how to securely document and share test results at different phases.

Team leaders and management can help ease the mindset change to automation by setting clear expectations and establishing a roadmap. Instead of trying to test the entire infrastructure, testing just several critical endpoints will help make sure people are smoothly adapting to the new approach. Banks, credit unions and lending firms can choose to develop skills in-house, or partner with expert providers who can provide insight on intelligent technology solutions.

The task of automation can often be trickier to figure out in the beginning and can be frustrating when it seems to add an extra step to the initial development process. However, by taking the time to optimize a system for continuous learning, banks, credit unions and lending firms will equip their team with the skills needed for success.