Commercial Online Banking

Preparing for Digital Platform Implementation

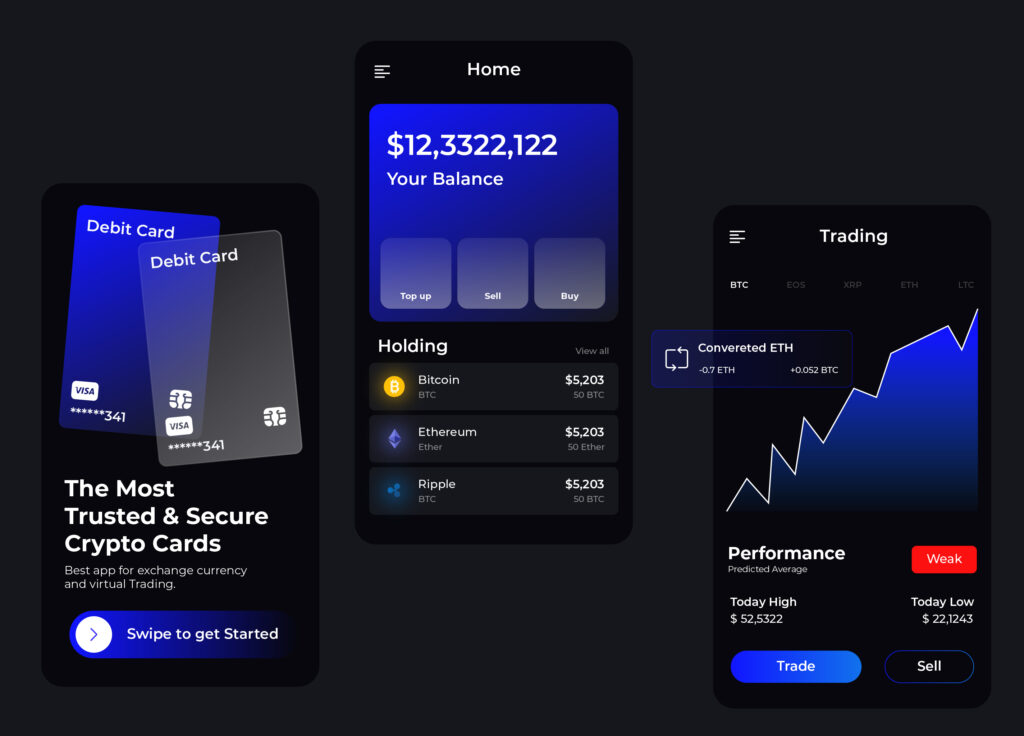

In an ever more digital business landscape, commercial banks are struggling to grow value-generating relationships and stay relevant. With the disruptions brought on by FinTechs, the changing demands of digitally savvy customers, and the recent economic challenges arising from the COVID-19 pandemic, more commercial banks are relying on digital transformation and digital banking platforms to attract new customers and generate business revenue.

Since the major consumption of financial services now takes place exclusively online, commercial banks— like their retail counterparts—are investing heavily in digital banking platforms and capabilities. Whether it’s a core conversion, a teller platform conversion, an online banking conversion, or any other type of system conversion, these digital initiatives usher in significant changes for the organization.

A typical approach taken by commercial banks is purchasing and implementing an online, digital banking platform that enables quick access to the features and functionality needed to engage and serve customers online. Even when leveraging a vended solution, however, implementing an online banking program is complex and requires a great deal of effort. Such programs are highly visible across the organization and their successful implementation will have a significant impact on customers, particularly high-value customers. For this reason, CIOs and line of business (LoB) leaders who are responsible for implementing online banking programs should focus on planning, an area that will set the program up for success.

To help CIOs and LoB leaders plan for success, this report will give guidance on:

- Overall planning for an online banking program

- Key areas to focus on when planning for an online banking program

- Typical project challenges

- Workable solutions for project challenges

- Overall planning for an online banking program

- Key areas to focus on when planning for an online banking program

- Typical project challenges

- Workable solutions for project challenges